Introduction:

In the ever-evolving landscape of the insurance industry, the integration of machine learning algorithms is fundamentally reshaping the way life insurance practices are executed. This article delves into the transformative power of machine learning, exploring how these algorithms are revolutionizing risk assessment, policy underwriting, and the overall landscape of life insurance.

1. Predicting Risk with Precision: Machine learning algorithms have ushered in a new era of predictive accuracy in life insurance. By analyzing vast datasets encompassing health records, lifestyle choices, and historical data, these algorithms can identify subtle patterns that were previously elusive. The result is a more nuanced understanding of risk, allowing insurers to tailor policies with unprecedented precision.

2. Personalized Underwriting: Gone are the days of one-size-fits-all underwriting. Machine learning enables insurers to craft personalized policies that reflect an individual’s unique risk profile. From health indicators to behavioral data, these algorithms consider a myriad of factors, ensuring that life insurance policies are finely tuned to meet the specific needs of each policyholder.

3. Dynamic Premium Calculations: Traditional actuarial methods are giving way to dynamic premium calculations powered by machine learning. These algorithms can adjust premiums in real-time based on changing risk factors, ensuring that policy pricing remains responsive and competitive. This dynamic approach enhances fairness, allowing policyholders to enjoy more accurately priced coverage.

4. Early Detection of Risks: Machine learning’s predictive capabilities extend beyond policy inception. Algorithms can actively monitor policyholders’ health data and lifestyle changes, enabling early detection of potential risks. This proactive approach not only benefits policyholders by promoting healthier lifestyles but also allows insurers to manage risks more effectively.

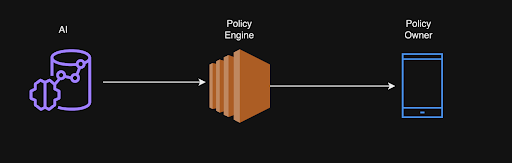

5. Streamlining Underwriting Processes: The traditional underwriting process often involves extensive paperwork and manual assessments. Machine learning streamlines these processes by automating data analysis and risk assessments. This not only reduces the time it takes to underwrite a policy but also minimizes the likelihood of errors, resulting in a more efficient and accurate underwriting workflow.

6. Enhanced Fraud Detection: Machine learning algorithms are formidable tools in the fight against insurance fraud. By analyzing vast datasets for patterns indicative of fraudulent activities, these algorithms can detect anomalies and irregularities that may go unnoticed by traditional fraud detection methods. This ensures the integrity of the insurance pool and prevents undue financial losses.

7. Improving Customer Experiences: The infusion of machine learning into life insurance practices is also enhancing the overall customer experience. Policyholders benefit from more transparent processes, personalized interactions, and fairer pricing. As machine learning continues to evolve, insurers can leverage these technologies to build stronger, trust-based relationships with their customers.

Conclusion:

The predictive pulse of machine learning is undeniably reshaping the landscape of life insurance practices. From precision in risk assessment to the crafting of personalized policies and the streamlining of underwriting processes, these algorithms are ushering in a new era of efficiency and accuracy. As insurers increasingly embrace the power of machine learning, the future of life insurance promises to be a dynamic, responsive, and customer-centric landscape where policies are not just written but crafted with a predictive pulse attuned to the unique needs and risks of everyone.

Interesting Related Article: “Machine Learning in Everyday Life: Real-World Applications We Encounter Daily“

from Technology Articles - Market Business News https://ift.tt/5Wl9VvQ

via IFTTT

1 Comments

The integration of machine learning in life insurance is truly reshaping the industry, optimizing risk assessment, and personalizing policies. This transformative shift ensures precision, dynamic premium calculations, and early risk detection. As the landscape evolves, embracing innovative solutions like Fund Loans becomes crucial for staying ahead in the rapidly changing insurance landscape.

ReplyDelete